Hit badly by the global financial crisis, debt-plagued Caribbean countries have struggled to recover ever since. After contractions in 2009 and 2010, average regional growth in real output has climbed very slowly and has not yet reached 2 per cent — although the Caribbean Development Bank projects it will pass that marker for 2015.

Greenfield investment levels have been erratic since the crisis and declined last year after hitting a peak of $9.1bn in 2013, according to estimates by fDi Markets, an FT data service.

Figures for 2015 are tracking behind last year’s performance so far. An FDI downturn can ill be afforded at a time when most countries in the region are suffering high unemployment and thus desperately need investment and jobs.

Demographics in the region should lend themselves to a strong, ready workforce — it is a youthful population with more than half of its people under the age of 30 — but stagnant economies and failing education systems have left many young people adrift.

Youth unemployment levels in the Caribbean are among the highest in the world, causing dangerous knock-on effects to crime and poverty as well as encouraging migration.

Unemployment on this scale can only be tackled with the support of foreign direct investment; while organic growth of domestic industries is part of the puzzle it cannot address the problem on its own.

Governments in the region are waking up to this fact and nascent investment-promotion efforts are under way in even some of the sleepier islands.

There is also now emerging a more collaborative approach to investment promotion at the regional level, as the tough economic times have convinced many governments they have more to gain, as small island nations, from banding together and tackling shared challenges that stymie investment than from each going its own way on the FDI front.

Caribbean countries have both the blessing and curse of being natural tourism magnets; the tourist industry still contributes the lion’s share of revenues but is a fickle industry prone to downturns.

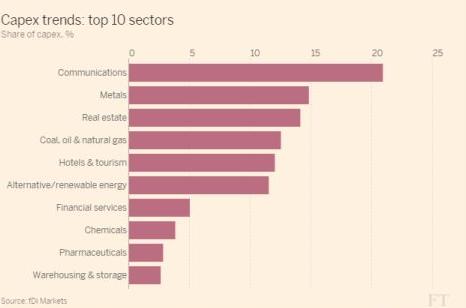

Yet, encouragingly, the region’s FDI portfolio is more diverse than might be assumed and is not entirely dominated by tourism. Since 2010, the communications sector has attracted the most capital investment, at an estimated $5.9bn, according to fDi Markets, followed by metals ($4.2bn); real estate ($4bn); coal, oil and natural gas ($3.5bn); and finally hotels and tourism ($3.4bn).

Grenada-based Lime, a subsidiary of UK-based Cable & Wireless Communications, is the most active telecoms company, making investments in a number of neighbouring countries in the past five years totalling an estimated $1.6bn.

By number of projects, business and financial services are most prolific, accounting for 118 projects since 2010. Alternative energy is of growing interest to Caribbean governments, and is now the sixth-ranked sector. Investment in such sectors as communications and energy can create a virtuous circle as they help address some weaknesses in the region’s business environment, as would more investment in roads and hard infrastructure.

But the largest impediment to investment in the Caribbean remains substandard skills and here the governments will have to invest more heavily in education to close the gap between the underemployed workforce and the types of jobs that could help lift the region’s youth out of poverty.

Foreign direct investors can take it from there, ideally providing the training that would allow Caribbean economies to move gradually up the value ladder. Article written by Courtney Fingar, courtesy http://www.ft.com/cms